Since insurance coverage business often tend to pay more insurance claims in high-risk areas, rates are typically higher. Celebrating a marriage usually causes lower insurance costs. Getting adequate coverage might not be low-cost, yet there are means to get a discount rate on your vehicle insurance coverage. Right here are 5 typical discounts you may certify for.

If you own your residence as opposed to leasing it, some insurance providers will certainly offer you a discount rate on your automobile insurance policy premium, also if your home is insured with another firm. Apart From New Hampshire and Virginia, every state in the nation calls for chauffeurs to maintain a minimum quantity of responsibility insurance coverage to drive legally (prices).

It may be appealing to stick with the minimal limitations your state requires to save money on your costs, but you could be placing on your own in danger. State minimums are infamously low and might leave you without sufficient protection if you're in a significant accident. Most experts recommend preserving enough coverage to secure your assets.

The quantity you'll pay for auto insurance is influenced by a number of extremely various factorsfrom the type of protection you have to your driving document to where you park your car. You might likewise pay more if you're a new vehicle driver without an insurance policy track record (insurance affordable). The even more miles you drive, the even more opportunity for Get more information mishaps so you'll pay even more if you drive your car for work, or utilize it to commute long ranges.

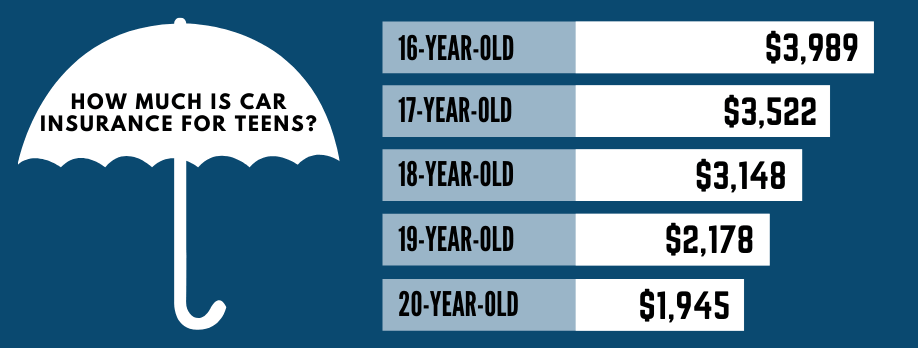

Insurance companies generally bill extra if teenagers or youths below age 25 drive your auto. Statistically, women often tend to get right into less mishaps, have fewer driver-under-the-influence crashes (DUIs) andmost importantlyhave much less severe accidents than males. auto. So all various other things being equal, ladies frequently pay less for car insurance policy than their male equivalents.

What Does How Much Auto Insurance Coverage Do I Need? Mean?

, as well as the kinds and amounts of plan choices (such as crash) that are prudent for you to have all impact just how much you'll pay for insurance coverage.

Just How Much Is Auto Insurance per Month? Drivers in the USA invest an average of $1,251 per year2 on automobile insurance coverage, making the ordinary cars and truck insurance coverage price monthly $104. This ordinary price is based on a full insurance coverage policy for a vehicle driver under 65 years old that has greater than 6 years of driving experience as well as a tidy driving record (cars).

We've gained a credibility for honesty as well as trust fund, and also we're honored to have a record of high customer scores for cases solutions (insurance companies). If you live in an area where your threat of being in a mishap is greater, your insurance coverage costs might be higher.

Here are a couple of factors that will certainly influence your insurance policy quotes: Driving history Credit history Age Postal code Cars And Truck Insurer Average Monthly Expense of Car Insurance Coverage by Car Kind The sort of car you drive can additionally impact your cars and truck insurance policy price. In many cases, auto insurance companies may bill much more for coverage on particular kinds of vehicles, including: Possessing a vehicle that is generally swiped can imply that your extensive insurance policy rates are greater.

These kinds of autos are frequently extra expensive to fix if they are harmed. In the instance of deluxe lorries, they're generally a lot more pricey to change if they're completed from a car accident. Due to the fact that these cars and trucks can take a trip at higher rates, people may drive them quicker and also be more most likely to obtain in a mishap or get a website traffic infraction. money.

cheap car insurance low-cost auto insurance car insured insurance

cheap car insurance low-cost auto insurance car insured insurance

Drivers under 25 have less experience when driving and also research studies reveal they trigger much more accidents. 3 So, if you or a person on your plan is under 25 years of ages, your automobile insurance policy premiums may be higher. Car insurance coverage rates may decrease after a vehicle driver turns 25, especially if they haven't had any type of at-fault accidents (dui).

What's The Average Cost Of Car Insurance? - Thestreet for Beginners

car business insurance insurance auto insurance

car business insurance insurance auto insurance

Commonly, if you more than 25 yet below 60 years old, your vehicle insurance policy expense per month will certainly be the least expensive. If you're not within that age array, you can still locate means to save. Actually, we use several unique rates and also discount rates with the AARP Vehicle Insurance Coverage Program from The Hartford.

If you have an AARP subscription, get a car insurance coverage quote today and also save - cars. How Much Is the Average Car Insurance per Month in My State?

cheap car low cost auto low cost business insurance

cheap car low cost auto low cost business insurance

One state's ordinary cars and truck insurance cost each month might be more than another's because it requires vehicle drivers to have more liability insurance coverage. On the various other hand, an additional state may average the most affordable auto insurance policy monthly since it requires a reduced minimum coverage. Tips to Conserve Cash on Your Month-to-month Cars And Truck Insurance Policy Settlement Compare vehicle insurance coverage quotes to ensure you're obtaining the finest rate - vehicle.

You might wish to think about including optional coverage so that you're completely covered. Ask for a risk-free driver discount rate if you have a clean driving document. auto insurance. Bundle auto and also house owners insurance policy. You might save up to 5% on your cars and truck protection as well as 20% on your house plan with The Hartford.

Regularly Asked Concerns Regarding Cars And Truck Insurance Coverage Price Just How Much is Automobile Insurance Coverage for a 25-Year-Old? Relying on your auto insurance policy business and also the responsibility insurance coverage you select, a 25-year-old might pay essentially than their state's average vehicle insurance expense each month. cheapest car. When you transform 25, you must contact your car insurer to see if you can save cash on your auto insurance policy price if you have an excellent driving background (cheapest).

You will certainly require to hold at least the minimum called for coverage in instance of a crash. You may likewise choose for added protection that will certainly boost your rate, however also boost your protection in the event of a crash (business insurance).

The Best Guide To Additional Resources - Edd - Ca.gov

auto insurance cheap car vehicle insurance car insured

auto insurance cheap car vehicle insurance car insured

What Autos Have the most affordable Insurance Policy Rates? When it comes to the ordinary cars and truck insurance coverage price per month for different kinds of vehicles, vans generally have the least pricey insurance policy premiums. Sedans normally have the highest possible automobile insurance policy price per month, while sporting activities energy cars and vehicles are valued in between. suvs.

At What Age Is Cars And Truck Insurance the Cheapest? No issue your age, if you want to reduce your automobile insurance policy rates, you need to locate an automobile insurance coverage firm that can use you discount rates as well as advantages.

Exactly how much car insurance policy do you require? The answer relies on a variety of variables, consisting of where you live, how much your automobile deserves, and what other assets you require to secure. Here's what you need to understand. Secret Takeaways Many states require you to have at least a minimal amount of insurance policy protection for any kind of injuries or residential or commercial property damages you trigger in an accident.

auto insurance risks liability suvs

auto insurance risks liability suvs

Comprehensive protection, additionally optional, protects versus other threats, such as theft or fire. Uninsured driver coverage, required in some states, shields you if you're hit by a driver who doesn't have insurance coverage. cheaper car. How Car Insurance coverage Functions A vehicle insurance plan is really a plan of numerous different sorts of insurance.